Determining a marketing budget is both an important and extremely challenging part of developing your law firm’s marketing plan. A budgeting process that recognizes trial and error is inevitable and that allows an adequate amount of time for success is recommended.

We have developed a basic template (see template) that allows for a structured consideration of the necessary elements. Based on marketing strategy, each firm would ultimately develop its own process.

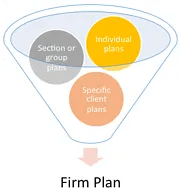

Our budgeting preference parallels the planning funnel shown below. We recommend a process that includes planning at various levels: individual, section or group, firm. It is also preferable to organize these plans around similar tasks to ensure that economic scaling is possible.

The main components of the budget would include:

- Funding thresholds

- Traditional marketing costs

- Inbound marketing costs

- Professional support

Within each of these areas are subsets (see template) of additional elements making up the broader categories. For example, funding model that is based on past results and planned revenues would contain a percentage apportionment to each category.

A mature practice with a strong track record of success and high market penetration may need a budget weighted in favor of maintaining the existing client base. Alternatively, a less mature but growing practice would benefit more from budget based on planned revenues. Consider the following scenarios:

SCENARIO 1: Mature Practice

SCENARIO 1: Mature Practice

Assumptions:

- This practice is presently billing $2.0 million annually

- This practice can only expand an additional 5% (based on client preferences, rates and competition)

- Attrition rate is 10% annually

- Legal resources are not easily translatable to other practice areas

- Business is healthy and there are no immediate disruptive threats

Client Acquisition Cost (CAC) averages $7,639 per, existing Client Maintenance Cost (CMC) averages $350 per and the average client relationship is $25,000 annually. The goals for this practice are to maintain the stability of the base and to create sufficient new relationships to cover the attrition rate.

Given the growth potential of this practice and the stated goal to replace business lost through attrition, a budget might look as follows:

|

|

|

PER CLIENT DATA |

|||

|

Fees |

Avg. Fees |

Clients |

CMC |

CAC |

|

|

Base recurring business |

1,800,000 |

25,000 |

72 |

350 |

|

|

New planned business |

200,000 |

25,000 |

8 |

7,639 |

|

|

Sub-total expected revenue |

2,000,000 |

||||

|

% Budget |

|||||

|

Existing client budget |

25,200 |

29% |

|||

|

New client budget |

61,112 |

71% |

|||

|

Sub-total |

86,312 |

||||

|

% Base revenue |

4.80% |

||||

|

% Expected revenue |

4.32% |

||||

As a result of existing Client Maintenance Costs (CMC) only being a fraction of new Client Acquisition Costs (CAC), it only takes about 30% of the budget to maintain the existing client base, leaving the remaining 70% for new client marketing. Notice that the overall budget, which is based on client maintenance and acquisition metrics, results in a cost range between 4.3% and 4.8% of expected and base revenues respectively.

What happens if a firm decides to arbitrarily cap marketing expenditures at a percentage of historical or expected revenue resulting in a smaller overall budget than the amounts indicated by the metric approach?

Many difficult decisions must be made in allocating a firm’s available marketing dollars. A firm must consider such questions:

- Is the actual allocated budget simply apportioned 70/30 as indicated?

- Should new client acquisition be put at risk to ensure the existing client base is well covered?

- Are there specific items in the budget that are more valuable than others?

- Does the firm decide to selectively increase and decrease budgets throughout the firm?

Having the data and approach that allows for thoughtful consideration of alternatives will force partners to develop quality marketing plans and inject accountability into the process.

![]() SCENARIO 2: Young Practice

SCENARIO 2: Young Practice

Assumptions:

- This practice is presently billing $300K annually

- This practice can expand at least 5 fold (based on client preferences, rates and competition)

- Attrition rate is not a factor due to the newness of the practice

- Legal resources, while transferrable to other practice areas, are better employed in the current practice area.

- Business is healthy, and there are no immediate disruptive threats

Average Client Acquisition Cost (CAC) is $7,639, average existing Client Maintenance Cost (CMC) is $350 and the average client relationship is also worth $25,000 annually. The average account lasts 4 years. The goals for this practice are to double revenues in the upcoming year.

Given the growth potential of this practice and the stated goal to double in the upcoming year, a budget may look as follows:

|

|

|

PER CLIENT DATA |

|||||

|

Fees |

Avg. Fees |

Clients |

CMC |

CAC |

|||

|

Base recurring business |

300,000 |

25,000 |

12 |

350 |

|

||

|

New planned business |

300,000 |

25,000 |

12 |

7,639 |

|||

|

Sub-total expected revenue |

600,000 |

||||||

|

|

|

% Budget |

|

|

|

||

|

Existing client budget |

4,200 |

4% |

|||||

|

New client budget |

91,668 |

96% |

|||||

|

Sub-total |

95,868 |

||||||

|

% Base revenue |

31.96% |

||||||

|

15.98% |

||||||

Candidly, this is the type of situation that will really test firm’s will to grow. This budget is actually larger than the budget for the mature practice area billing $2.0 million annually. Additionally, this budget calls for almost 32% of existing revenue and almost 16% of expected revenue.

Building on the previous discussion, is it worth it to spend $92K on $300,000 in annual business? Assuming the average account lasts 4 years, the new client revenue is really worth $1,200,000. Once the new client acquisition cost is absorbed, the costs of maintaining an existing account are negligible.

We will review metrics that address the lifetime value of an account compared to acquisition cost in our next post.

Assuming these two practice examples are from the same firm, an issue may arise as to what funding level is appropriate for a particular practice. Firms would do well to analyze and fund practices based on potential opportunity, plan quality and ability to execute. Large practice partners normally enjoy large measures of power, and it takes a concerted effort to ensure these partners see the benefits of investing in a high growth practice area.

|

If you would like to discuss how PerformLaw can assist your firm in developing an effective marketing budget, set up an initial phone consultation at no cost to you.

|

|

.webp?width=124&height=108&name=PerformLaw_Logo_Experts3%20(1).webp)