A sound process for admitting current partners and laterals

Admitting new law partners at the right level can be a challenge to law firms. This is especially true for first-generation firms. Whether a new partner is being promoted from their current ranks or a lateral partner is being hired from another firm, placing a new partner at the right level is much easier if compensation does not depend on equity share. Partner placements are also less complicated when a firm has a process for routinely adjusting ownership.

In previous posts, we have discussed determining law firm partner salary based on contributed profit and changing equity based on a rolling average of that added profit. If you missed those posts want to review them, find articles about determining law firm partner salary here:

| POST: Using Data to Determine Compensation |

| POST: Aligning Equity With Contributed Profits |

Consider the following example of admitting a new partner from a firm's current attorney group:

Compensation and equity-based on contributed profit

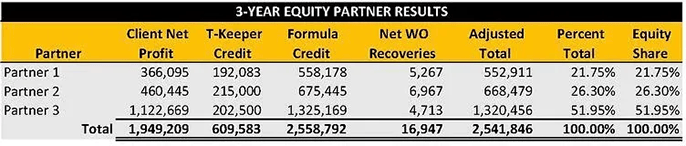

Building on our prior example of a three-partner firm (this system can work for any size law firm), the table below indicates each partner’s equity share that was determined using the 3-year profit results.

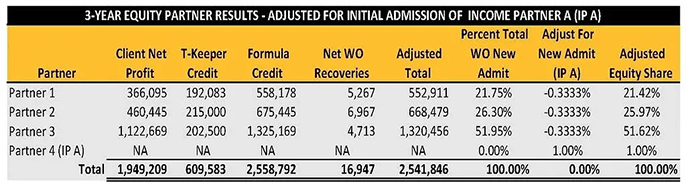

The partners have voted to admit Income Partner A to the equity level. As this firm pays based on contributed profit and adjusts ownership annually based on a three-year rolling average of added profit, Income Partner A's starting ownership share is 1%. Note that the partners have agreed that all new initial interests are surrendered by the existing equity partners equally.

Alternatively, it is common for current partners to provide shares for new partners in proportion to their existing ownership shares. As this system eventually adjusts all partners to their level of contributed profits, and initial ownership percentages not typically significant, both methods work well.

Finally, assume initial buy-ins, if any, for goodwill are handled between the partners individually and do not affect partner capital accounts.

Consider the following example:

The initial admission of Income Partner A – Initially granted a 1% of ownership.

To accomplish the admission of Income Partner A, now Partner 4 (P4), with one percent ownership, each partner provides 1/3 of the needed shares. Partner 4's shares will remain at 1 % for three years. Recall that is the firm's policy to adjust equity on a 3-year rolling average of contributed profits.

The remaining partners (P1, P2, and P3) will continue to change using measurements that exclude P4’s results and 1% ownership share (99%). At the end of the three-year period, all equity levels, including P4’s, are adjusted to reflect each partner's average profits for that period.

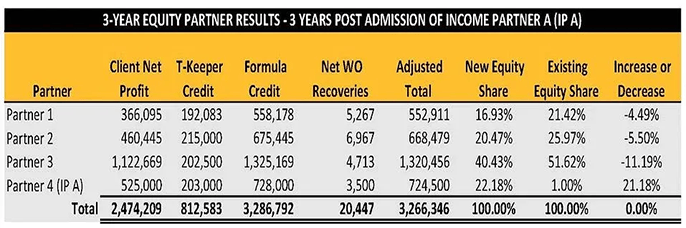

For the sake of simplicity, assume the all other partners remained constant, and Partner 4’s three-year rolling average result is as indicated in the table below:

Equity adjusted using prior 3-year average results

Partner 4’s three-year profitability indicates a 21.18% equity share. The remaining partners also adjust to their three-year rolling average profits. See the last column to the right for the effect of these adjustments.

As law firm partner salary in this example is allocated based on contributed profits, no compensation adjustment would result from this change in equity.

It is worth mentioning that some firms may have a solid three-year track record with an attorney and may choose to enter those results into the ownership alignment process immediately. As a result, no three-year adjustment process is necessary, and equity continues to adjust annually.

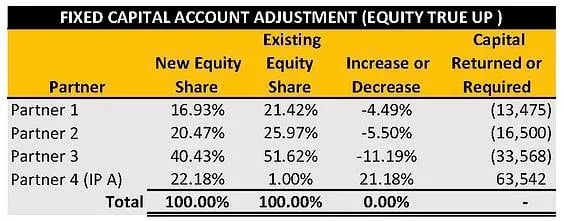

The final step in the process includes a reconciliation of paid-in capital. Firms that keep a fixed capital account require law partners to contribute based on ownership share. Rarely do we encounter law firms that require capital contributions based on some other method. In our prior post, the partners in our sample firm have agreed to maintain a $300,000 fixed capital account. The following table indicates the impact of P4's equity adjustment on each partner's capital account.

Notice that Partner 4 will owe a substantial capital contribution ($63,542) at the time of the equity adjustment. Law Firm Partners 1, 2 and 3, will have a portion of their paid-in capital returned to them. Going forward, paid-in capital balances for each partner will adjust using a three-year rolling average of contributed profits.

Finally, firms that use debt instead of paid-in capital may have a degree of difficulty increasing and decreasing guarantees with changes in equity. Banks are often reluctant to relinquish guarantees from more financially able partners. These instances require a degree of creativity to satisfy banking requirements and to apportion risk among the partners fairly.

![]() For more information on any of these law firm partner compensation or admitting new law firm partners, check out these resources and articles:

For more information on any of these law firm partner compensation or admitting new law firm partners, check out these resources and articles:

-

Slicing the Pie: Paying Originators, Managers and Workers

-

PRESENTATION: Admitting New Law Firm Partners

-

Law Firm Managing Partners Compensation

.webp?width=124&height=108&name=PerformLaw_Logo_Experts3%20(1).webp)